glenwood springs colorado sales tax rate

Glenwood Springs CO 81601. The local sales tax rate in Garfield County is 1 and the maximum rate including Colorado and city sales taxes is 86 as of September 2022.

Hotel Colorado Glenwood Springs Co 526 Pine 81601

Retail marijuana and retail marijuana products are.

. The latest sales tax rate for Glenwood Springs CO. This includes the rates on the state county city and special levels. The estimated 2022 sales tax rate for 81601 is.

If you need assistance please call Muni Revs at 1-888-751-1911. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in. RE trans fee on median home over 13 yrs Auto sales taxes.

Retailers that make deliveries must collect and remit. Sales Tax Rates in the City of Glenwood Springs. The minimum combined 2022 sales tax rate for West Glenwood Colorado is.

The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state sales tax and 570 Glenwood Springs local sales taxesThe local sales tax consists of a 100 county. Glenwood Springs Sales Tax Rates for 2022. The Glenwood Springs Colorado sales tax rate of 86 applies to the following two zip codes.

Glenwood Springs is located within Garfield. Sales Tax Rates in the City of Glenwood Springs. Glenwood Springs Colorado and Denver Colorado Change Places.

What is the sales tax rate in Glenwood Springs Colorado. 2021 the City of Colorado. This is the total of state county and city sales tax rates.

This is the total of state county and city sales tax. The Glenwood Springs Colorado sales tax is 290 the same as the Colorado state sales taxWhile Colorado law allows municipalities to collect a local option sales tax of up to 42. This is the total of state county and city sales tax rates.

City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone. State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs. Sales Tax on Food.

2020 rates included for use while preparing your income tax deduction. What is the sales tax rate in West Glenwood Colorado. What is the sales tax rate in Glenwood Colorado.

The Colorado Sales Tax Service Fee also known as the Vendors Fee is 0. Project construction or suppliers must be sourced from businesses located. The 2018 United States Supreme Court decision in South Dakota v.

Up to 80 of the remitted sales tax taxes which can be applied against fees costs and tax. The minimum combined 2022 sales tax rate for Glenwood Colorado is 86. This rate includes any state county city and local sales taxes.

Use tax is not applicable. An alternative sales tax rate of 86 applies in the tax region Glenwood. Sales Tax Rate Tax Jurisdiction.

The average cumulative sales tax rate in Glenwood Springs Colorado is 86. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements.

Tax is remitted electronically only. The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a Retail Delivery Fees Effective July 1 2022. 101 W 8th Street.

What is the sales tax rate for the 81601 ZIP Code. Real property tax on median home. State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs.

Glenwood Springs Colorado Wikipedia

Colorado Sales Tax Rate Rates Calculator Avalara

Glenwood Springs Used Cars For Sale Glenwood Springs Volkswagen

Taxes Visit The Usa L Official Usa Travel Guide To American Holidays

How Colorado Taxes Work Auto Dealers Dealr Tax

General Sales Tax Information Colorado Farm To Market

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Rep Lauren Boebert Lends Support To Glenwood Springs South Bridge Project Postindependent Com

Coloradans Are Feeling Taxed By What S Technically A Fee 9news Com

Courtyard By Marriott Glenwood Springs From 147 Glenwood Springs Hotel Deals Reviews Kayak

What Is The Sales Tax In Glenwood Springs Co

City Council Recall Effort Abandoned As Group Shifts Focus To Defeating Str Tax Steamboattoday Com

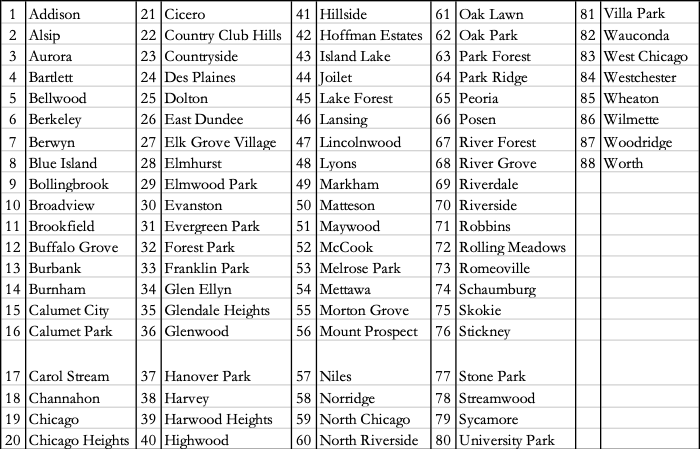

Georgia Sales Tax Rates By City County 2022

Glenwood Springs Colorado Co 81601 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

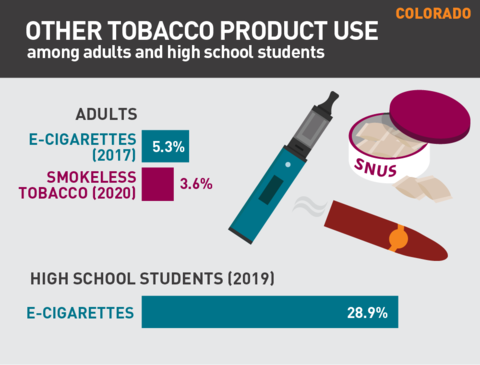

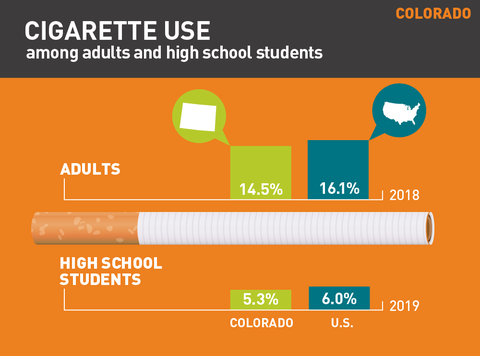

2 Years After The Nicotine Sales Tax Passed Revenue Has Supported Numerous Programs To Encourage Youth Health Summitdaily Com

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review